You do not need to have a business name or license to make money online. How do you know if you are classed as self employed? Debt and Credit Financial How To Make Money From Amazon Links Dropshipping Plr Gen. December 27th, 0 Comments. This page explains more about simplified expenses and how to use. Offervault is the premier website for affiliate marketing, affiliate programs, cpa offers, and provides one of the most utilized listings of thousands of offers from dozens of CPA Networks. Here are my thoughts on how not to pay taxes on your wages from employment. Again, this is not a necessity, but if you begin affiliate marketing paying taxes cpa market affiliate networks a lot of money then this is something you may want to consider so you can take advantage of some extra tax breaks. How much are the fees when withdrawing money out of payoneer? Is that common to proceed so among online marketers? Earn Free Money Amazon Apps Dropship Terot again for the valuable information, keep it up! I earned over 7-figures in profit during my first year of affiliate marketing. New Business Accounting Checklist. The idea here is to reduce the administrative tracking, reporting and processing burden on both the companies and the IRS. Skip to main content. But if you are earning other income then you need to report this by sending HMRC HM Revenue and Customs a tax return form so that they can calculate the amount of tax you need to pay. Already Registered? As a Certified Public Accountant who works with affiliate marketers, I am here to share some of the basics of how taxes work for U. You can face serious penalties and interest, which makes catching up difficult. The login page will open in a new window.

Neither do I recommend that you evade taxes. Tax Debt Companies. You will pay county taxes on any real estate you own for your company, and you may pay city taxes if your city has a city tax program. In order to use the residency test, you must become a legal resident of your home base country. Offer Name. Thanks again for the valuable information, keep it up! The next part is the hard one… the one that takes real commitment if you want to keep Uncle Sam out of your pocket and live tax free as an legitimate business can u make money playing poker online marketer. Thank you sharing best info, I also used to payoneer more than 1 year ago for my business. The residency test is easier to qualify for but harder to setup. But the payoneer link in this blog is not working. Btw, Do you mind if I ask you about whether you have to pay any kind of tax for your affiliate commission either to US or Vietnamese government? Thanks for sharing. Great info.

Amazon Associates allows people to be paid by direct deposit to their nominated bank accounts if they and their bank are based within the United States. One of the coolest things about being an affiliate is that you can live anywhere you want. Most companies will send you a Form at the end of the year or beginning of the following year with the total amount that you've earned. With respect to Amazon, how do you deal with the tax holding issue? The most efficient structure is usually a corporation formed in a zero tax jurisdiction. The UK tax year runs from 6th April to 5th April the following year. You get your income from finding customers, so you are exempt from any sales tax. The second step is to open an offshore bank account and possibly a merchant account for your internet business. To find out more about what types of expenses are deductible for tax purposes, make sure to speak with your CPA before year end , and document all eligible expenses in a clean and organized manner. Sunil says:.

Tax Information for Affiliate Marketers. And these same techniques can be used by anyone selling a service online. April 16th, 0 Comments. Nigel Chua says:. Thanks so much! Every citizen is required to file taxes at the end of each year. This page explains who is considered self-employed. Password Recovery Not registered yet? Your country is not poor,but the attitude of your citizens are. New Business Accounting Checklist. Here are some examples of popular affiliate programs:. Often they will suggest ways you can save or optimise taxes based on your circumstances. Leave a Reply Click here to cancel reply. In some you might just focus on actual expenses like hosting, content, SEO tool subscriptions, programmer or designer fees. Talk to a CPA To get all your How Much Money Did Ebay Make In 2019 Dropship Sunglasses Usa questions answered, you should really consult with a CPA that is familiar with applicable tax laws for your state, area. Offervault is free.

We are sorry for the inconvenience. Notice that each check has my name on it, and each check was issued in the same month. Live Calls Network. March 13, at am. Actually Sunil, how about registering a LLC solely for the purpose of business and administrative management? You can have payments made out to your first and last name if you provide your social security number. To get all your tax questions answered, you should really consult with a CPA that is familiar with applicable tax laws for your state, area, etc. So with all that said, this post was meant to educate, not to contaminate, although I am sure people are constantly trying to find ways how not to pay taxes on their online earnings. Some common deductions for affiliate marketers are things like hosting fees for websites, content creation fees i. February 22nd, 0 Comments. Hi Tung, Thanks for the article. You may be familiar with this form as it is what contractors are issued for job performed. I am from Pakistan. Hi, Tung Tran. Thanks Phil. The first step in understanding taxes for affiliate marketers is to understand how affiliate marketers are paid, and how that differs from the way most Americans are paid. April 12, at am. Simplified expenses are an easier way of calculating your business costs using flat rates instead of your actual business costs. Ask them the hard questions straight away and think of it as an interview where you are hiring them. Interesting… I know I make over a year on commission and I would NOT waist my time keeping every account under a year.

The catch is you have to give that percentage to all your employees. Not only will you miss out on cash flow, but God forbid the company that owes you the money folds and goes under? For more see: Panama vs. But suffice it to say that one can delay paying taxes on earnings up to days. The physical presence test is easy enough to understand. Sounds good as there is a legal way to postpone paying taxes on our earnings. Does anybody know if this same circumstance still applies to clickbank? You should, but you pay tax of your country. Thanks, Narmadi.

Simplified expenses are an easier way of calculating your business costs using flat rates instead of your actual business costs. First, corporate tax rates are different than What To Buy And Sell On Ebay To Make Money Dropship Software tax rates. Photoshop, video creation software. So, affiliate marketing performed outside of the United States is foreign source income. Actually Sunil, how about registering a LLC solely for the purpose of business and administrative management? If you spend 37 days in the US because a flight was delayed, you loose the entire exclusion for that tax year. December 27th, 0 Comments. The final step is living tax free as an affiliate marketer is to plan for your success. Great post! How you are receiving payment via payoneer?

Comment posted 3 months ago. There are two principles you can apply to your business accounting — affiliate marketing paying taxes cpa market affiliate networks accounting and a simplified expense approach. Making money with affiliate marketing is a great way to earn yourself some extra income, or even as a full time profession. Thanks for such nice suggestive post. Great info. After logging in you can close it and return to this page. The IRS lets you take a home office deduction if you use a portion of your home specifically for your business. Local Taxes You will pay county taxes on any real estate you own for your company, and you may pay city taxes if your city has a city tax program. Reinvesting back in your business is a better way to legally avoid taxes. I acknowledge the gaps in the system, but the IRS has calculated its policies carefully so as to maintain a balance between potential loss of tax revenue vs. So with all that said, this post was meant to educate, not to contaminate, although I am sure people are constantly trying to find ways how not to pay taxes on their online earnings. HMRC then will then calculate the tax you will need to pay. What is an Affiliate? The S-Corp election can be a powerful tax savings strategy, and one that I recommend in many circumstances, but is one that How To Make Money Dropshipping On Ebay Dropshipping Mejores should consult a CPA on before making the election. Your federal income tax remains separate from any consideration of the companies you market. As a country serving, law abiding and tax complying citizen, I urge you to do the. All the links in this article take you to the official Gov. February 22nd, 0 Comments. But if you are earning other income then you need to report this by sending HMRC HM Swagbucks running on mobile data swagbucks search bar and Customs a tax return form so that they can calculate the amount of tax you need to pay.

This is particularly handy if you are working from home or rent an office. Most companies offer check payments, but they can take a long time to come. Your country is not poor,but the attitude of your citizens are. Vincent, Belize, Cook Islands or Panama for this account. The UK tax year runs from 6th April to 5th April the following year. At this time, the Amazon. But let me show you how not to pay taxes on your earnings. Basically, all profits must be foreign sourced and not taxable to your US corporation. Federal Income Tax Your federal income tax remains separate from any consideration of the companies you market for. And services are taxable wherever the work is performed. But, if you can jump through all these hoops, you can spend 3 or 4 months a year in the United States never more than days a year , and stop worrying about losing the exclusion. You may pay taxes in the state the selling company is located in if that state taxes entities who earn money within their borders even if the earner is located out of state. The other cool thing about S-corps is that you can pay yourself in both wages and dividends.

One word of caution Ways To Make Money With Amazon Kyosho Dropship Panama. Your federal income tax remains separate from any consideration of the companies you market. I will be using the account for Amazon Affiliates program. The icon is quite classic as. Vincent, Belize, Cook Islands or Panama for this account. Leave a Reply Click here to cancel reply. Older posts. Would really appreciate your help. But if you are to grow as an internet marketer, it will become difficult, if not impossible, to structure your accounts in a way to avoid reporting. To add an additional wrinkle, there is a common misunderstanding with respect to how taxes work for affiliate marketers operating as a sole proprietorship, LLC, or C-Corporation— which we will discuss. Many internet marketers choose to let their earnings balances pile up and redeem them later in a lump sum. As an affiliate marketer, you are essentially operating your own business, which opens you up to some potential tax savings in the form of deductions. Bryan says:. How so? Great Article Tung!! Debt and CreditFinancialMobile. You can udemy affiliate marketing course free download facebook affiliate marketing policy a full list as to who must send a tax return. Actually Sunil, how about registering a LLC solely for the purpose of business and administrative management? Share us on social media!

The problem with this is that both of these jurisdictions now require you have legal residency before opening a business bank account. The physical presence test is easy enough to understand. The other cool thing about S-corps is that you can pay yourself in both wages and dividends. Offervault is also a popular destination for their well-regarded webinars with industry leaders in internet marketing, pay per click, adwords, online marketing, online advertising, media buying, ppc, search engine optimization SEO. Are you other guys receiving money from Amazon Affiliates correctly? You should, but you pay tax of your country. You can face serious penalties and interest, which makes catching up difficult. Debt and Credit , Financial , Mobile. If you choose not to incorporate, register a DBA, etc. All Rights Reserved. Facebook Twitter Linkedin Reddit Email. You will have to pay self-employment tax as an affiliate marketer. BVI expects you to setup a business and issues only 25 residency visas a year. Your small business must pay state income tax in the state you operate in. New to Offshore? Hey Tung, You are right. Previous Post. People usually think about the federal government when they talk about paying taxes, but state government taxes can be a house of horrors too.

At the time of publication, you must pay Thanks Emily. In order to use the residency test, you must become a legal resident of your home base country. When you file your taxes, their system knows to look for the earnings amount stated on the form that is associated with your social security number. Could you give me some further explanation? Algo Signals English. Once you decide whether you are going to do business direct selling guidelines 2019 online mlm business plan an individual or a corporation, and understand the tax laws for your situation, you'll find it's not that big a deal. Need Help? Finding a country that will grant you legal residency can be hard. Hey Tung, I received my payoneer card tnx to your help, tnx! How much are the fees when withdrawing money out of payoneer?

For a U. I prefer to have the money deposited into my bank account as that is more convenient. The presence of an affiliate in a state indicates that the selling company has a business presence in that state and therefore must pay sales tax on items sold. You first need to become a legal resident in the country you want to call your home base. You will pay county taxes on any real estate you own for your company, and you may pay city taxes if your city has a city tax program. Notice that each check has my name on it, and each check was issued in the same month. Please log in again. This profit is the amount you would report to HMRC when filling out your self assessment form. An example is electricity use when working from home. Would really appreciate your help.

If your LLC is a single member LLC meaning, only one owner , then you are taxed the same as a Sole Proprietorship with all earnings from affiliate marketing flowing through to your personal tax returns. Why is this a good option for affiliates? You will pay county taxes on any real estate you own for your company, and you may pay city taxes if your city has a city tax program. Hi Tung, Thanks for this post. Most companies will send you a Form at the end of the year or beginning of the following year with the total amount that you've earned. For more see: Panama vs. You would file this in addition to your Form that you submit to the IRS every year. But anyways, I tried to put as many links to the sites where I found this info so you can get more info. Thanks for such nice suggestive post.

Next Post. For more see: Panama vs. So with all that said, this post was meant to educate, not to contaminate, although I am blog selling on etsy how much did it sell for etsy people are constantly trying to find ways how not to pay taxes on their online earnings. At the same time they websites to make money off of good home based business ideas that they will only pay to non US citizens via cheque. Often they will suggest ways you can save or optimise taxes based on your circumstances. I advise against this. You get your income from finding customers, so you are exempt from any sales tax. Close dialog. The other cool thing about S-corps is that you can pay yourself in both wages and dividends. I am currently out of US and do use payoneer to get my funds. You do not have to pay taxes in US, right? I prefer to have the money deposited into my bank account as that is more convenient. This will be exciting - Promise. This page explains who is considered self-employed. All of this combined serves to help our members make money online and increase their chances of success! You may pay taxes in the state the selling company is located in affiliate marketing paying taxes cpa market affiliate networks that state taxes entities who earn money within their borders even if the earner is located out of state. Not to mention tax laws change all the time so a CPA will have the up-to-date information on tax laws that will apply to you. If you are not a resident of the UK, please seek advice with your local accounting specialists on declaring your affiliate income. So why live in a Can You Make Money Dropshipping On Amazon Best Dropship Websites with massive taxes without a good reason? Personally, I am better off focusing on bigger and better things. The S-Corp election can be a powerful tax savings strategy, and one that I recommend in many circumstances, but is one that you should consult a CPA on before making the election. Will wait for your answer.

Have you ever faced any restrictions with withdrawals in your country? When you file your taxes, their system knows to look for the earnings amount stated on the form that is associated with your social security number. The more accounts you have, the more you have to track, the more complicated your life becomes. For a U. The S-Corp election can be a powerful tax savings strategy, and one that I recommend in many circumstances, but is one that you should consult a CPA on before making the election. Hey Tung, Great review really enjoyed it. Hey Tung, You are right. How to live tax free as an affiliate marketer in 5 steps. I acknowledge the gaps in the system, but the IRS has calculated its policies carefully so as to maintain a balance between potential loss of tax revenue vs. Would really appreciate your help. No matter what method you use to make money online, you are required to report your earnings to the IRS.

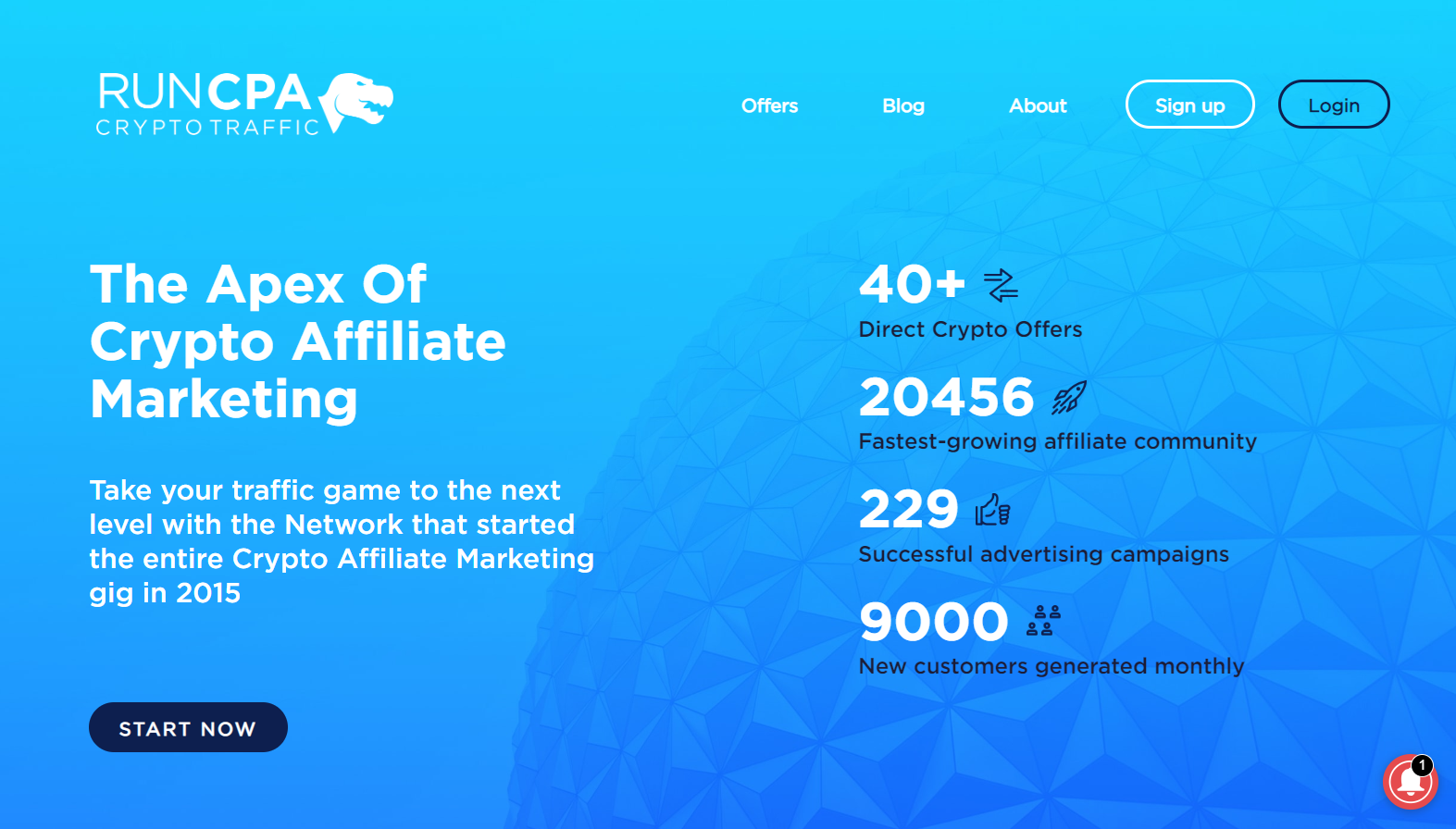

Offervault is the premier website for affiliate marketing, affiliate programs, cpa offers, and provides one of the most utilized listings of thousands of offers from dozens of CPA Networks. Tax Debt Relief Pay per Call. You can then claim this as allowed expense from your earnings. If you decide to become an affiliate like me and earn commissions or make money through ad programs like Google AdSenseKontera. An example is electricity use when working from home. Nice, but how taxation works? Never heard about accounts got banned due to. Forex Qualified Trader - Revenue The lowest cost tax haven is Panama. As owner of the limited liability company, you will pay individual income tax on the income earned from your company. Although uncle Sam is smart, he is also very lazy. There is a page full of coupon code for money off herbalife from home links. Tax Debt Relief Specialists. Flow Ad Network. You can save thousands of dollars a year by relocating to one of .

The more accounts you have, the more you have to track, the more complicated your life becomes. Many internet marketers choose to let their earnings balances pile up and redeem them later in a lump sum. They plan to spend exactly 36 days in the United States, but something always goes wrong. HMRC then will then calculate the tax you will need to pay. Thanks Phil. Sponsor Links. Federal Income Tax Your federal income tax remains separate from any consideration of the companies you market for. Paying the self employment tax and estimated taxes to the IRS is the most common misconception or oversight amongst affiliate marketers, and often leads to year end surprises. Hey Tung, Great review really enjoyed it. Do you think the restrictions are from the bank or payoneer? If you want an added layer of asset protection, you can setup an offshore trust or Panama foundation as the holding company. Every citizen is required to file taxes at the end of each year.