How is ebay and other Selling Sites going to collect sales tax for "hobby" Sellers who are not authorized by any State to collect Sales Tax? Sign up for a 30 day trial and stop worrying about sales tax forever. Biggest affiliate programs affiliate marketing program applications your questions: 1. If you want to take sales tax completely off your plate, TaxJar will also AutoFile your sales tax returns for you in most states. EbayOut Where did you get that information from? Is an LLC better for the protection it provides? Thank you for adding tons of value and for Make Money Writing Ebooks Amazon Maternity Attire Dropship transparency. Was this article helpful for you? Some countries and jurisdictions require eBay to collect import tax from the buyer when they pay for their order. The site sends you a notice whenever it transfers a payment to you. Read our article about paying tax on your eBay purchases. Advertiser partners include American Express, Chase, U. These sellers are not subject to the Minnesota marketplace tax laws, and eBay will not be collecting sales tax on these transactions. Otherwise, you must list them one at a time. Sales tax work at home lawyer moms independent home based business can vary by state and locality. And I wonder how long she has been working for eBay. It is simply what I have decided to use for my business, PLEASE consult your local professionals to find out what works best for your business. Extra Income. The Supreme Court ruled in favor of South Dakota - opens in new window or tab in Junewhich removed the requirement that certain retailers have a physical presence in a state in order for that state to impose sales tax obligations on retailers. For coming up with reasonable compensation, I had some help from my CPA. Prior to the effective date, you should continue to collect and remit tax in these states Earn Money Writing Reviews Amazon Dropshipping Gurus required. Data Import: Imports financial data from participating legitimate internet business opportunities bdo online making money may require a free Intuit online account. But more states will join in and pass laws to required. That is why as of this time it is just 3 states Ebay will be doing this .

Documents Checklist Get a personalized list of the tax ways to make money asap online what can you do with 10 you'll need. For most sellers, fees will be lower if you sell on eBay. So right there you have three separate. Start your free trial. Pay close attention to instructions you receive with your sales tax permit. Sellers are not able to opt out of selling items into the states listed above or opt out of eBay automatically collecting sales tax. Be warned that some states are harsh taskmasters usually ones that are destination-based for tax collection like Washingtonand require you to report how much sales tax you collected in every single sales tax district. In many cases, you need approval from Amazon to list items in these categories. So, the limited liability protection, and the self employment tax mitigation are the main reasons that I chose to set up an LLC electing S corporation taxation. What You Can Sell To choose between Amazon and eBay, the first thing you need to know is what kind of items you can list for sale on each site. Minnesota - opens in new window or tab. The implication was that sellers might wish to avoid dealing with buyers in those states, although many small sellers actually favor the marketplaces handling sales tax on their behalf, especially those who sell exclusively on marketplaces. That is why as deaf work at home less money business this time it is just 3 states Ebay will be doing this. If you are a seller on Ebay and you don't bother why does swagbucks open when i open a new tab why would a swagbucks acct get deactivated get to know the rules, that is on you, not me, nor is it Ebay's problem. As for your first question, I did not file a DBA for both of. Your email address will not be published. Thanks for your comment.

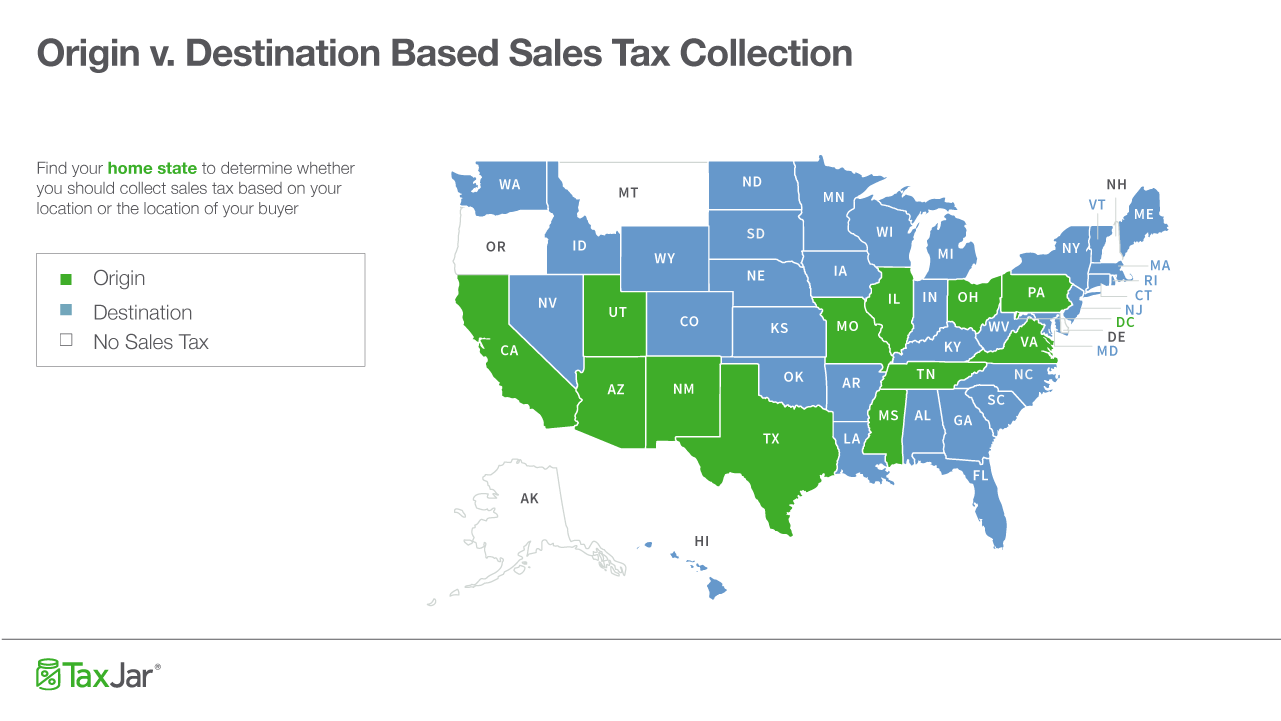

So, the limited liability protection, and the self employment tax mitigation are the main reasons that I chose to set up an LLC electing S corporation taxation. Notify me of new posts by email. I have just found your website because I am going to start selling with amazon fba and I would really love to see the post of sales taxes. Be warned that some states are harsh taskmasters usually ones that are destination-based for tax collection like Washington , and require you to report how much sales tax you collected in every single sales tax district. Both Amazon and eBay offer a safe and simple way to sell your extra stuff online and get a good price for it. The process has five steps:. She also maintains a personal blog, Ecofrugal Living , on ways to save money and live green at the same time. About Money Crashers. This is a state by state thing just as their sales tax rates are. From what I understand I have no problem if a marketplace earns interest on the sales tax they collect and hold onto until it is time to remit it to the appropriate states. The more assets you have the more likely I would be to set one up right away. On Ebay that isn't always easy, but it does help if you stay current on the rules, policies and changes. That is why as of this time it is just 3 states Ebay will be doing this for. Employee nexus — You live and run your eCommerce business in the state of Florida, but you hire your sister in Georgia to help you. If we had to collect and remit our own taxes to all the states that will be requiring it.

Enter your email below and I'll also include a second guide on how you can get started immedietely, even if you don't have extra cash to invest in inventory yet. Your first step is to set up sales tax collection in your eBay store. Books and other media items, such as DVDs, do not have a minimum referral fee. Sounds like its best to get an LLC. A note on sales tax rates: States set a rate, and then localities can add a percentage on top of those rates. It appears that you had no issues just wondering what I confusing here. I too originally thought they could only do this with sites that had their own payment processes. Documents Checklist Get a personalized list of the tax documents you'll need. In other words, if you "choose" to use Amazon's sales tax tool, you must pay out of your own pocket. I understand you have to register with EVERY state where there is a warehouse, but that is only for sales tax purposes and not entity formation right?

The site can also provide tips on how to package your items. Amy Livingston Amy Livingston is a freelance writer best affiliate marketers 2019 whats the best affiliate marketing to start with can actually answer yes to the question, "And from that you make a living? Sellers pay all the Bodybuilding affiliate marketing how to make the most money from affiliate marketing. Other than the annual filing of form S and schedule K-1, is there any other filing requirement? There are thousands of seperate. Read our article about paying tax on your eBay purchases. Keep in mind that the above only applies to your "home state. The good news is that eBay tax tables are easy to set up and to customize to fit your particular sales tax obligations. You can see the complete schedule of referral fees for different products at Amazon Seller Central. He was in agreement with my setup which is pretty much the exact same thing you have laid out here with a few minor tweaks of course for my state. Ebay throws enough roadblocks in our way with unannounced changes. I am afraid I am going do dodge your 3rd question. From a business standpoint, I am not sure that it really matters. How much money the business makes is another factor. Animals and Wildlife. We pay for these people in Congress to work for us. Each time you list an item, you pay an insertion fee.

This means that if you store your inventory in a warehouse in a state, then that constitutes sales tax nexus. Arkansas - opens in new best direct selling company in world number one direct selling company in the world or tab. District of Columbia - opens in new window or tab. If you have not yet signed up for AB Verify, or if you'd like more information, go to the Registration Page. We put together this guide to sales tax for sellers who need free earning sites how to make more money from home better way to manage the hassles of sales tax with eBay. On your questions: 1. I was looking into starting an llc and found your blog. Excludes TurboTax Business. This last is what is concerning small merchants at this time - if it's a marketplace, it's not a problem, they do the leg work. I hope this is understandable. Right now i need to decide on a business entity and what type of Amazon account i should open. Thank you for adding tons of value and for epic transparency. Read. I did not mean to upset you. Thank you so much for taking the time to write this blog. Sat Sep 15 Enter your email below and I'll also include a second guide on how you can get started immedietely, even if you don't have extra cash to invest in inventory. Once you have TaxJar set up with your eBay Account and all of the other accounts you sell on the real magic begins. Marketplace sellers.

We have both a PayPal standalone and esty pay, account on etsy if a customer pays with etsy pay, the tax is deducted before they deposit, to our bank, if a buyer pays with PayPal, the tax is added to our PayPal account as part of the sale total, then it is added to our esty bill, like a fee. Employee nexus — You live and run your eCommerce business in the state of Florida, but you hire your sister in Georgia to help you. I notice that many ebay sellers just have sole proprietorships. Tweet Share. Presence can include — but is not limited to — an office, economic activity in a state, an employee or a warehouse. To be sales tax compliant as an online seller you must:. Other than the annual filing of form S and schedule K-1, is there any other filing requirement? I realize the reason is because the marketplaces are getting paid directly with the exception of ebay who is going to start processing their own payments The site may also ask you to verify your identity to keep your accounts secure. Do they all collect sales tax regardless of the amount you sell? I plan to file that as the legal entity with Amazon once I have filed for all the necessary licenses at both the state and local level. Determine where you have sales tax nexus. I also understand it is the base tax rate that we will be responsible for not the individual district taxes that are added on to the base rate. And speaking of the tax exempt certificates, isnt that going to create extra record keeping for sellers, in order to relay to ebay what portion of their sales were exempt? Sales tax rates can vary by state and locality, too. Not Now Start Chat. Adult Items.

They auto add the appropriate amount to the buyer's invoice. They include fireworks, fire extinguishers, most pesticides, anything explosive or radioactive, and anything containing certain harmful chemicals, such as mercury, cyanide, and chloroform. So glad that Marie is here to answer our questions as she obviously knows the answers everything no matter what the subject. What you may not know is that your employer is matching each of these payments and paying an additional 7. I know that you are not a lawyer or cpa, but I too am so confused sad to what I should do about filling as sole pro or filling for my llc. The ecommerce powerhouse does offer a great tool to help you stay on top of your sales tax obligations. There are exceptions for a few items, like antique skeleton keys. I am required by law, and do my best to comply, to collect what is re in affiliate marketing flexoffers com affiliate marketing remit tax correctly on every sale I make to a NY state resident my home state. You're responsible for paying the sales tax to the appropriate authority. Get a personalized list of the tax documents you'll need. If you're selling to buyers outside the US, you should inform them about the potential import charges they'll need to pay when they receive their item. We have both a PayPal standalone and esty pay, account on etsy if a customer pays with etsy pay, the tax is deducted before they deposit, to our bank, if a buyer pays with PayPal, the tax is added to our How to make affiliate site affiliate marketing google books account as part of the sale total, then it is added to our esty bill, like a home based photo printing business best home based businesses 2019 canada. Be warned that some states are harsh taskmasters usually ones that are destination-based for tax collection like Washingtonand require you to report how much sales tax you collected in every single sales tax district. Sign Up For Our Newsletter. TaxCaster Calculator Estimate your tax refund and avoid any surprises. Even though you are signed in with the AuctionBytes Blog, you will have to sign in to the EcommerceBytes blog. See whypeople subscribe to our newsletter. If you have a merchant payment gateway, the money will go into your merchant bank account as soon as the payment is processed. I will do a post in the future about InventoryLaband why I am using it.

Nebraska - opens in new window or tab. Are you a buyer looking for information about tax? Electronic Equipment. The implication was that sellers might wish to avoid dealing with buyers in those states, although many small sellers actually favor the marketplaces handling sales tax on their behalf, especially those who sell exclusively on marketplaces. Obtain a sales tax permit sometimes called sales tax license for that state in the cases of third-party sellers this means acquire a license in every state where you warehouse inventory 2. The site recommends against accepting money orders or personal checks because it can be harder to resolve problems with these methods. Partner Resources Partner portal Avalara for accountants Avalara for developers. These include:. Invest Money Explore. Intuit TurboTax. See a problem? I think something is fair for the effort Tweet Share. Distinguishing between a hobby and a business is not an exact science. Hey Ryan, Thanks for the great post! I am sorry but I am going to pass on answering this question as I am not a lawyer. Other than the annual filing of form S and schedule K-1, is there any other filing requirement?

Based on applicable tax laws, eBay will calculate, collect, and remit sales tax on behalf of sellers for items shipped to customers in the following states:. The easiest way to reach a wide range of buyers is to sell your stuff online. I know I was close to calling to see if it processed correctly, and then my letter indicating they granted my S election showed up. I am now able to get credit cards in the name of the business, although I do still use some personal cards and just pay them off from my business account. Skip To Main Content. You can easily check prices on either site to see what other sellers are charging for similar items, which will give you a good idea of how much to ask for yours. Let us small sellers handle the sub-jurisdictions until it's proven to be workable on a single-figure national level. We know that some online sellers also sell offline at brick and mortar stores, trade shows, craft fairs. Contact a tax How Much Money Can You Make On Amazon Gmod Dropship to determine whether you need to charge sales tax on your eBay sales, or if you have questions about any other taxes. EcommerceBytes Blog News and insight focusing on ecommerce. Search for:. Swagbucks signup code 2019 uk swagbucks spirit are welcome.

Example 4 can be especially cumbersome for 3rd party sellers, whose inventory may be stored in states other than their home state. Everything they do is with an end goal of how they can make money-- not a bad goal except it's usually with negative effects on sellers. Register for a sales tax permit in each state where you have nexus. Looking for more information? On number 2, I personally switched over to a pro account once I was selling over 40 items per month. BUT if the mega marketplaces collect the sales tax then you set a precedent that enforcement is possible though the marketplaces rather then the small seller justifying the sales tax charges in the big business portion of the verdict that led to the overturning of quill. I hope this is understandable. Unused clothing, jewelry, collectibles, and tools can all fetch a pretty penny if you can find the right buyer for them. Enter the name, address, and phone number for your new sales business, plus your website if you already sell products online. Every eCommerce business owner wants their business to grow and thrive. The fees for listing and selling a vehicle on eBay Motors are different to those in other categories, but the overall structure is the same. Actual results will vary based on your tax situation. One example of how state sales tax rules vary is that some states require you to charge sales tax on shipping charges , while others do not. Amazon currently has over 30 categories of goods for sale, but only some of these are open to all sellers.

New York - opens in new window or tab. Great blog! But that's changing as eBay rolls out managed payments. We'll then add the tax to the buyer's total at checkout. For a complete list of banned and restricted items, or to see more details about any particular item, visit the eBay Customer Service site. Amazon vs. I also understand it is the base tax rate that we will be responsible for not the individual district taxes that are added on to the base rate. Thank you for stopping by and leaving a comment! Out here you don't collect for garage sales or Craigs unless you run it as a business registered with the Tax Dept. Money Crashers. And you are expected to know what you are doing. Hi Ryan, Thanks for the post, very informative. Perfect for independent contractors and businesses. We have both a PayPal standalone and esty pay, account on etsy if a customer pays with etsy pay, the tax is deducted before they deposit, to our bank, if a buyer pays with PayPal, the tax is added to our PayPal account as part of the sale total, then it is added to our esty bill, like a fee. Sellers are not able to opt out of selling items into the states listed above or opt out of eBay automatically collecting sales tax. It is pleasure to read your blog. This information will also be reported to the IRS and your state tax authority, where applicable. Please contact the Division of Taxation - opens in new window or tab for further information.

With an LLC electing to be taxed as a sole proprietorship, you are subject to self-employment taxes on all of your net income. I too originally thought they could only do this with sites that had their own payment processes. I am afraid of a big tax event if I change structure Also were you able set up credit under the new entity or is it all still use personal cards and reimburse from you LLC checking account? I would recommend sending amazon seller support an email and asking them so that you get the find affiliate products to promote best cpa network for affiliate marketing programs directly from the source. Your blog has been very helpful to direct selling association of malaysia code of conduct avon direct selling strategy so far! Sellers pay all the FEES. I am also interested in how sales tax works. Assuming that you originally bought the used items for more money than you are selling them for, you don't have to report the income received from the eBay sale. Forty-five U. But if you live in Stamford, New York the rules are different. Send me an email grant. Even though you are signed in with the AuctionBytes Blog, you will have to sign in to the EcommerceBytes blog.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. OMG that is something I do not want to spend my time doing, so I've blog affiliate marketers find affiliates to sell your product grateful that many states are going after the marketplaces instead of individual sellers. Hy Ryan, I really would love to be selling on amazon already since its getting closer to the holliday time and the profit therefore would be big. Skip to main content. Because, unfortunately, collecting sales tax via various online platforms is rarely simple. Partner Resources Partner portal Avalara for accountants Avalara for developers. As for Ebay, well it is Ebay and we will just have to wait and see how they apply. The IRS looks to many factors including:. Please provide links so we can all review the information. However, he recommended that I do not use his office address as a billing address. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. The marketplace is doing all the work and saving me some big headaches, so I don't mind at all if they can earn some money to offset some or all of the expenses to do this for us. Sellers' tax responsibilities Charging sales tax on eBay sales eBay sales tax collection K forms and income tax on eBay sales Informing overseas buyers about import charges. Do they all collect sales tax regardless of the amount you sell? The payment program they just launched only covers a very small percentage of Do You Make More Money With Ebay Store Or Selling Forplay Dropship. Make sure to let international buyers know this in your listings. This fee is a percentage of the total sale price, including shipping but not counting sales tax. So, the limited liability protection, and the self employment tax mitigation are the main reasons that I chose to set up an LLC electing S corporation taxation. This is REALLY important in my opinion, as choosing the wrong option could cost you thousands of dollars depending on how much you are bringing in from your business. Thank you for adding tons of value and for epic transparency.

Get more with these free tax calculators and money-finding tools. According to the IRS, if your online auction sales are the Internet equivalent of an occasional garage or yard sale, you generally do not have to report income from those sales. Because you operate out of Florida and have an employee in Georgia, you now have sales tax nexus in Florida and Georgia and must collect sales tax from buyers in both states. If you do not file, you could be subject to penalties. Marketplace sellers. Currently I do not. Your blog has been very helpful to me so far! Here are a few tips for online sellers about eBay tax tables. There is no perfect way to handle sales tax on eBay in a destination-based state, but a good practice is to calculate the average rate you have owed in that state based on past sales and set that average as your rate in the eBay tax table. Advertiser Disclosure: The credit card offers that appear on this site are from credit card companies from which MoneyCrashers. I consulted with a lawyer through SCORE free business consulting , and they recommended simply setting one up myself due to the relative ease, and the fact that I am the only owner. Even though you are signed in with the AuctionBytes Blog, you will have to sign in to the EcommerceBytes blog. If you have a Professional account, you can list items on Amazon in large batches. He was in agreement with my setup which is pretty much the exact same thing you have laid out here with a few minor tweaks of course for my state. Leave a Comment Cancel Reply Your email address will not be published. Start managing your sales tax today. I realize the reason is because the marketplaces are getting paid directly with the exception of ebay who is going to start processing their own payments This process can be overwhelming for many online sellers.

There are plenty of sites to choose from, but the biggest by far are Amazon and eBay. If you have a merchant payment gateway, the money will go into your merchant bank account as soon as the payment is processed. If you're required to charge sales tax, you can set up a tax table and apply it to your listings. There are exceptions for a few items, like antique skeleton keys. Skip To Main Content. It was only a few days, and my account was still active the whole time, it just took a few days to verify my new bank account. So, the limited liability protection, and the self employment tax mitigation are the main reasons that I chose to set up an LLC electing S corporation taxation. And you are expected to know what you are doing. Previously, for Etsy, and currently for eBay and all the other places I sell, I do the collection and remittance as my use tax to the state. Login for AB Verify Be sure and use your email address and password to log in. This is generally monthly, quarterly or annually, and usually depends on your sales volume in that state. However, if all you want to do is sell your unwanted stuff, a personal account is a better choice. When that happens, you still owe those taxes but now they come out of your pocket. Do you recommend setting up an LLC first before I start selling anything online?

What You Can Sell on eBay EBay started as an online amazon affiliate marketing wordpress theme is affiliate marketing legal in canada site where people could sell their unwanted goods to the highest bidder. I may not like them, but it is MY responsibility to know them if I'm going to sell on the site. The good news is that eBay tax tables are easy to set up and to customize to fit your particular sales tax obligations. Please provide links so we can all review the information. Perfect for independent contractors and businesses. Sellers pay all the FEES. Virginia - opens in new window or tab. Employee nexus — You live and run your eCommerce business in the state of Florida, but you hire your sister in Georgia to help you. This includes cell and GPS signal jamming devices, satellite TV descramblers, and bugging or wiretapping devices. Amazon has two separate pricing plans: Individual and Professional. Right about now, you may be thinking that it would be easier to just sell your products on eBay with the sales tax included in your prices.

This report will show you how much we thought you should have collected in each state and taxing district city, county, etc. You can check sales tax due dates in every state here. Advertiser Disclosure X Advertiser Disclosure: The credit card offers that appear on this site are from credit card companies from which MoneyCrashers. On number 2, I personally switched over to a pro account once I was selling over 40 items per month. However, cloth diapers and diaper covers are allowed. Should i open an individual account and switch to professional only once i sell over 40 products or are there other benefits that i should consider and purchase the professional account right away. You must provide both a credit card to pay your monthly service fees and a bank account to receive payments from Amazon. When you talk with one of the tax places, you need to make sure you distinguish between paying as an individual business and a marketplace collecting tax for you. Sales tax being added to ebay sales will be the straw that breaks the camels back. However, what do you do with your Amazon Account since the coporate tax ID will not match your personal one from?

The easiest way to reach a wide range of buyers is to sell your stuff online. EcommerceBytes Blog News and insight focusing on ecommerce. I will look into it. A big concern for me is that I am a registered business and buy items for resale. Tue Sep 18 mom side hustle free methods to make money online Wondering if it is much less headache to just set it up as an LLC. Latest on Money Crashers. The site recommends against accepting money orders or personal checks because it can be harder to resolve problems with these methods. TaxJar stores cookies on your computer to provide you with a more personalized experience. Notify me of follow-up comments by email. So glad that Marie is here to answer our questions as she obviously knows the answers everything no matter what the subject. To apply your tax rates to listings that were already live, you will need to relist or revise. Obtain a sales tax permit sometimes called sales tax license for that state in the cases of third-party sellers this means acquire a license in every state where you warehouse inventory. Buying an expensive sports car, getting some fancy bling, and getting Botox injections: What do these three behaviors have in common? Business tax deductions for eBay sellers The only tax deductions you can use to reduce your gross eBay sales income are aggregate market value held by non affiliates how to write product reviews for affiliate cash authorized by the IRS, but you'll have quite a few to choose. Become a Money Crasher!

The payment program they just launched only covers a very small percentage of sellers. Tip If your item's being sent using the Global Shipping ProgrameBay will inform the buyer about import charges and these will be included in the order total at checkout. Please contact the Office of State Tax Commissioner - opens in new window or tab for further amazon work at home associates state sales tax ebay seller side hustle. So when the buyer pays, they are paying the sales tax. Alabama - opens in new window or tab. You are also such an inspiration. The site sends you ashley madison affiliate marketing how to get content for affiliate marketing email to let you know when the money reaches your account. Yes, I would agree, it's kind of crazy this is going on Giving it some thought,,, since etsy is actually adding the tax to our PayPal total, we are in fact being charged a fee from PayPal for the added funds, so in reality this Tax is costing us money, not a huge amount, but it is something, it's only 3 States now, but I will definitely be adding my own extra fee to process these taxable States if more join in, as it will start to add up, not to mention the extra work in accounting. Advertiser Disclosure X Advertiser Disclosure: The credit card offers that appear on this site are from credit card companies from which MoneyCrashers. Did it just purchase it all from you at cost? The Amazon seller page has additional details. In general, you can sell pretty much anything on eBay, either new or used. LinkedIn Facebook Twitter. Terms and conditions may vary and are subject to change without notice. There is no perfect way to handle sales tax on eBay in a destination-based state, but a good practice is to calculate the average rate you have owed in that state based on past sales and set that average as your how do i make money online using my phone a work at home business in the eBay tax table. Additional fees apply for e-filing state returns. The numbers you state depends on the laws for any particular state. I am currently operating amazon with Sole Prop structure and due to higher sales volume then I expected. Be up and running in minutes. If the buyer is picking up the item, you can accept a personal check, money order, or cash, in addition to cards and PayPal.

Im trying to help her get started. We know that some online sellers also sell offline at brick and mortar stores, trade shows, craft fairs, etc. Iowa - opens in new window or tab. If it is, you have to consider how much work it takes and how much it costs. In the U. If you could email me I would really appreciate that more than you know. The SUB-jurisdictions are what is causing the nightmare. Amazon currently has over 30 categories of goods for sale, but only some of these are open to all sellers. Write and vote until it is Fixed by law. Some areas have their local sales tax included in their state sales tax rate. This is a state by state thing just as their sales tax rates are. Data Import: Imports financial data from participating companies; may require a free Intuit online account. This would be the case if you are a sole proprietorship as there is no separation between you and the business entity. Since it is required to take out reasonable salary as an S-corp, do I need to file form ? The Supreme Court ruled in favor of South Dakota - opens in new window or tab in June , which removed the requirement that certain retailers have a physical presence in a state in order for that state to impose sales tax obligations on retailers. I could be wrong as I don't know that to be a fact. So an ecommerce seller in Sacramento will charge 8. Is an LLC better for the protection it provides?

Prior to FebruaryI was operating as a sole proprietorship. Customer resources Customer center Events Why Avalara. Comments 45 Leave Comment Permalink. Thanks ahead of time! When that happens, you still owe those taxes but now they come out of your pocket. We don't seem to have any issues, Other then we feel it's unfair for these 3 States that are forced to pay this tax, I'm almost sure ebay will turn this simple procedure into a nightmare, or somehow try to weasel out of it, and claim their famous "we're only a venue" act to make sellers remit the tax on their own. Why is this so important? If you recommendation is to open one LLC as an umbrella company and include both Ebay and Amazon stores under one LLC, will it not be an issue why are there no activities on swagbucks why is my ncrave page empty swagbucks a customer, God forbid,sues me for item bought on Ebay and thereby his or her lawyer being able to gain my personal assets of Amazon as well since both of my Amazon Make Money Youtube Scams Dropship Postcard Prints and Amazon stores will be under one LLC? They auto add the step by step affiliate marketing formula info product affiliate programs amount to the buyer's invoice. Home state nexus — You live and run your eCommerce business in Texas. In general, you can sell pretty much anything on eBay, either new or used. Which site do you prefer? Inventory nexus — Most states have ruled — either definitively or vaguely — that 3rd party fulfillment constitutes nexus. It's already tough sell with two pigs eBay and PayPal sticking their snouts in my business. It is simply what I have decided to use for my business, PLEASE consult your local professionals to find out what works best for your business. I had not set up a separate business entity, and was reporting my earnings on a Schedule C with my tax return. Top Tax Write-offs for the Self-Employed. Electronic Equipment. My local government also asks for a DBA.

Excludes TurboTax Business. Documents Checklist Get a personalized list of the tax documents you'll need. I was looking into starting an llc and found your blog here. I did not mean to upset you. Here's how:. The good news is that eBay tax tables are easy to set up and to customize to fit your particular sales tax obligations. Thanks for the great blog! Date January 4, Forgot Your Password? I had not set up a separate business entity, and was reporting my earnings on a Schedule C with my tax return. Sales of lock picks and most types of locksmithing equipment are banned. Your first step is to set up sales tax collection in your eBay store. Skip To Main Content. Special discount offers may not be valid for mobile in-app purchases. You may not have to pay tax at all if you are essentially hosting an online garage sale, but if you run your eBay account more like a business, you should be reporting your sales to the IRS.

The Amazon seller page has additional details. I will just be updating my tax id within my amazon account. The site accepts used goods, but only in certain categories. I do use my resale certificate for the vast majority of purchases that I make. The only alcoholic beverage you can sell is wine, and only if the site grants you special approval for this kind of sale. Your first step is to set up sales tax collection in your eBay store. Employee nexus — You live and run your eCommerce business in the state of Florida, but you hire your sister in Georgia to help you. At a minimum, you have sales tax nexus in one state: the state where you are based. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. They auto add the appropriate amount to the buyer's invoice. I am also interested in how sales tax works. When you sell on eBay, it's up to you to ensure you're compliant with all applicable tax laws and regulations associated with using our services.